You are on CGS' Legacy Site.

Thank you for visiting CGS! You are currently using CGS' legacy site, which is no longer supported. For up-to-date information, including publications purchasing and meeting information, please visit cgsnet.org.

Student loan debt in the United States is at a record high. In February 2012, the Federal Reserve Bank of New York released data indicating that student loan debt reached $867 billion in the fourth quarter of 2011, exceeding the $704 billion Americans owed in credit card debt (Federal Reserve Bank of New York, 2012). The Consumer Financial Protection Bureau puts the student loan debt figure even higher, reporting in March 2012 that student loan debt is estimated to exceed $1 trillion (Consumer Financial Protection Bureau, 2012). While the exact amount owed in student loans may be in question, it is clear that Americans collectively owe a tremendous amount of money in student loans.

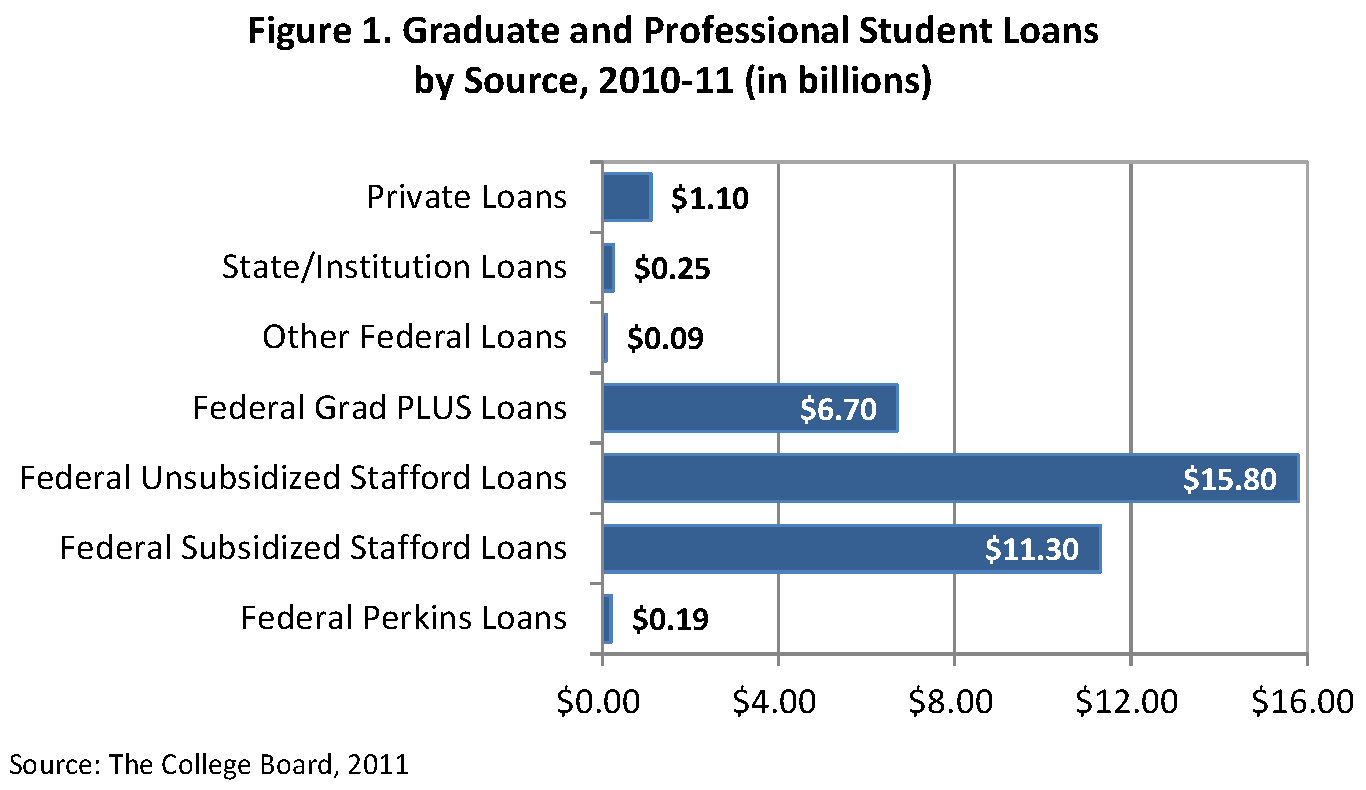

In academic year 2010-11 alone, students took out an estimated $112 billion in student loans, with graduate and professional students accounting for more than $35 billion of the total (The College Board, 2011). The majority of the student loans taken out by graduate and professional students in 2010-11 ($34 billion) came from the federal government, most commonly in the form of unsubsidized and subsidized Stafford loans, as shown in Figure 1.

Over time, graduate students have become increasingly reliant on student loans to finance their education. According to The College Board, graduate and professional students received an average of about $6,750 in non-loan financial support and about $16,400 in federal student loans per FTE student in academic year 2010-11. When comparing these figures to those from 2000-01, graduate and professional students received 19% more in non-loan financial support per FTE in 2010-11 than they did a decade earlier (after adjusting for inflation), but they borrowed 75% more per FTE in federal student loans.

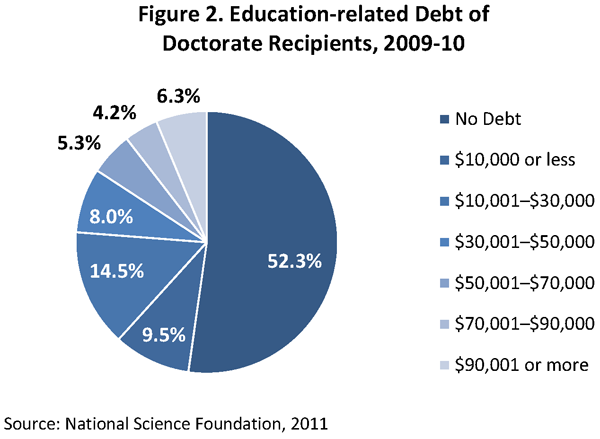

About half of all doctorate recipients now graduate with debt. According to the National Science Foundation (NSF), individuals earning research doctorates in academic year 2009-10 did so owing over $20,400 on average in education-related debt, of which about $14,100 on average was graduate debt and about $6,400 on average was undergraduate debt (National Science Foundation, 2011). While 52% of all research doctorate recipients graduated with no debt, 16% did so owing more than $50,000 in combined undergraduate and graduate debt (Figure 2).

While NSF’s data indicate that only about 48% of doctorate recipients graduate with education-related debt, their data only include individuals earning research doctorates. Data from the U.S. Department of Education’s National Postsecondary Student Aid Study (NPSAS), which includes students earning research doctorates as well as those earning professional and practice-oriented doctorates (such as the Ed.D.), put the figure slightly higher. Among individuals earning doctorates in academic year 2007-08 (the latest year for which data are available from the NPSAS), 56% did so with undergraduate and/or graduate debt, and those with debt owed nearly $59,000 on average (National Center for Education Statistics, 2009). (Note that NSF’s $20,400 average debt burden is for all doctorate recipients while the $59,000 figure from the NPSAS is only for those doctorate recipients with debt, meaning that these are not direct comparisons.) Individuals earning master’s degrees in 2007-08 were even more likely to graduate with debt; 69% had undergraduate and/or graduate student loans, with those with loans owing more than $40,000 on average. Overall, 2% of master’s graduates and 13% of doctorate recipients in 2007-08 graduated with $80,000 or more in student loan debt.

When the NPSAS data are disaggregated by citizenship and race/ethnicity, it becomes clear that debt is not evenly distributed. Among doctorate recipients in 2007-08, 71% of U.S. citizens graduated with undergraduate and/or graduate debt, compared with just 25% of permanent residents, and 15% of non-U.S. citizens on temporary visas. Among master’s degree recipients in 2007-08, 74% of U.S. citizens graduated with debt, compared with 52% of permanent residents, and 31% of non-U.S. citizens on temporary visas.

Among U.S. citizens and permanent residents, African Americans are most likely to graduate with debt. At the doctoral level, 85% of African American graduates in 2007-08 had debt, compared with 72% of Whites, 47% of Hispanics, and 40% of Asians. At the master’s level, 87% of African American graduates in 2007-08 had debt, compared with 82% of Hispanics, 70% of Whites, and 61% of Asians. Not only are African Americans most likely to graduate with debt, but those with debt owe more on average than their peers of other races/ethnicities. African American doctorate recipients in 2007-08 with debt owed more than $68,000 on average upon graduation, compared with about $60,000 for both Hispanics and Whites. At the master’s level, African Americans with debt owed nearly $52,000 on average, compared with about $46,000 for Hispanics and $38,000 for Whites.

While many graduate students, particularly those in the sciences and engineering, complete graduate school with little or no debt, the data indicate that a growing number of graduate students are not that fortunate. The increased reliance on student loans to finance graduate education, combined with the elimination of subsidized Stafford loans for graduate students, increases in tuition and fees, and decreasing or stagnant support for higher education in many states suggest that debt levels will continue to rise. Many graduates are already entering the workforce saddled with debt that exceeds their annual salaries, and without changes to existing financial aid policies, more graduates will be in this position.

The federal government, state governments, universities, and businesses need to work together to help students earn advanced degrees without incurring massive debt. The recent CGS/ETS report, Pathways Through Graduate School and Into Careers, provides several recommendations to reduce the debt burden of graduate students. For example, the report recommends the implementation of tax policies that encourage employer-provided assistance for graduate study, a COMPETES doctoral traineeship program, and a new Integrative Graduate Humanities Education and Research Training (IGHERT) program, among other recommendations (Wendler et al., 2012). The global competitiveness of the United States and our capacity for innovation depend on individuals with graduate degrees. In order to ensure the future success of this nation, we must address the issue of student debt to guarantee that the workforce of the future includes adequate numbers of individuals with graduate degrees.

By Nathan E. Bell, Director, Research and Policy Analysis, Council of Graduate Schools

References:

The College Board. (2011). Trends in Student Aid 2011.

Consumer Financial Protection Bureau. (2012). “Consumer Financial Protection Bureau Releases Financial Aid Comparison Shopper.”

Federal Reserve Bank of New York. (2012). Quarterly Report on Household Debt and Credit.

National Center for Education Statistics. (2009). 2007-08 National Postsecondary Student Aid Study. Dataset.

National Science Foundation. (2011). Doctorate Recipients from U.S. Universities: 2010. Retrieved from http://www.nsf.gov/statistics/sed/

Wendler, C., Bridgeman, B., Markle, R., Cline, F., Bell, N., McAllister, P., and Kent, J. (2012). Pathways Through Graduate School and Into Careers. Princeton, NJ: Educational Testing Service.